Zusammenfassung

Highligts

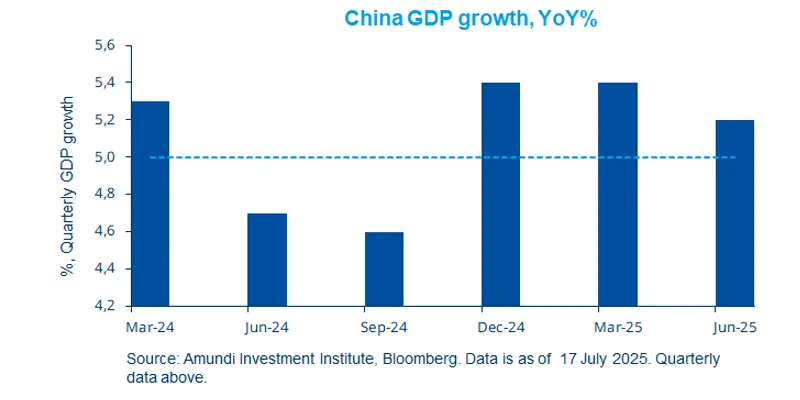

Despite the ongoing trade war with the United States, China’s growth remained resilient thanks to trade diversification* into non-US markets.

China is set to reach its 5% growth target for 2025, with less need for additional fiscal stimulus this year.

While ongoing trade negotiations will keep uncertainty high, we see areas of resilience across emerging economies.

In this edition

The US Fed kept interest rates unchanged in the 4.25-4.50% range at its March policy meeting. Citing risks around elevated uncertainty from trade policies, the Fed prefers to wait and see given that the uncertainty is “remarkably high”. We think partly because of this uncertainty, the central bank slightly reduced its economic growth forecasts for this year and mentioned that US tariff policy may delay progress on slowing inflation. The Bank of England (BoE) and the Bank of Japan (BoJ) also held rates steady. The BoE still expects inflation pressures to ease but reiterated the need for a “gradual and careful approach.“ We think a global approach to quality credit and select bonds could potentially boost prospects for long-term returns.

Key dates

22 July Fed Chair Powell Speech, South Korea Consumer Confidence | 24 July ECB interest rate decision, EZ Composite PMIs, US Composite PMI |

UK Retail Sales, US |

*Diversification does not guarantee a profit or protect against losses.

Read more